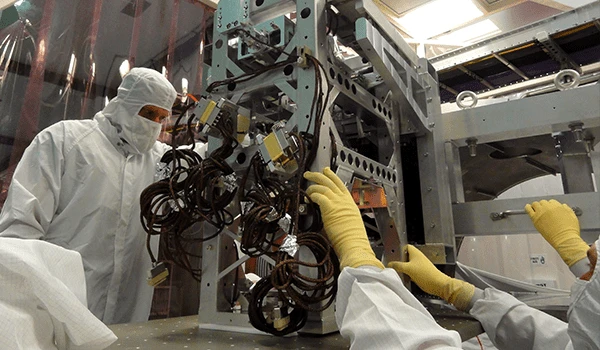

The Research and Development (R&D) Tax Credit program in Louisiana encourages businesses to engage in R&D activities by offering up to a 30% tax credit on qualified research expenditures. This incentive is designed to support companies in developing innovative products and technologies within the state.

Eligibility

- Open to businesses with R&D expenditures incurred in Louisiana.

- Only research and development conducted within the state qualifies for the credit.

Benefits

- Up to a 30% tax credit on qualified R&D expenditures.

- No cap and no minimum requirement, providing flexibility for businesses of all sizes.

Ineligible Businesses

- Professional services firms and businesses engaged in custom manufacturing or fabricating without a pending or issued U.S. patent related to the qualified research expenditures.

Application Process

- Complete the Application: Submit the application online with the necessary documentation and fee.

- Review: LED staff reviews the application, and businesses are notified of approval or denial.

- Claim the Credits: If approved, businesses can claim the tax credits by filing or amending their state income tax return.

For further information and to apply, visit Research and Development Tax Credit Program.